1. Who Needs a Weight Distance Tax Permit

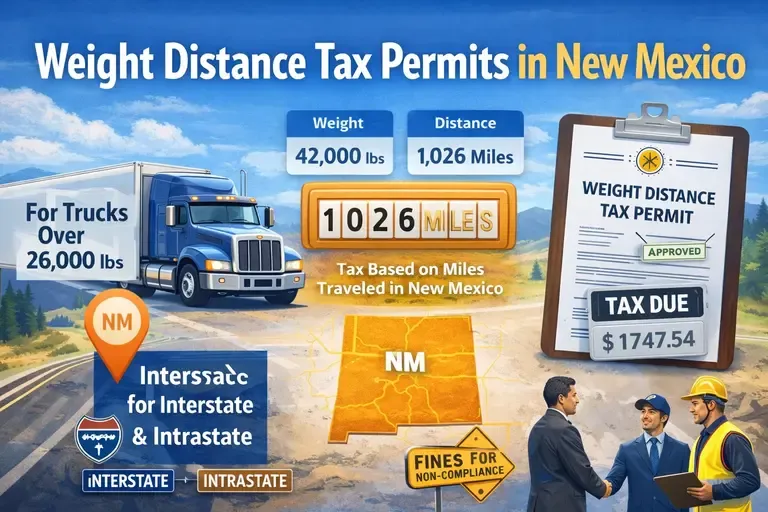

You must have a Weight Distance Tax Permit in New Mexico if your commercial vehicle:

-

Has a gross vehicle weight over 26,000 lbs, or

-

Is part of a fleet that exceeds the legal weight limits, or

-

Operates interstate or intrastate routes on public highways.

Smaller vehicles under 26,000 lbs typically do not require this permit.

2. How the Tax Works

The tax is calculated based on:

-

Distance traveled in New Mexico (miles)

-

Weight of the vehicle (gross vehicle weight)

-

Type of vehicle (e.g., truck, trailer, combination)

Example: A 50,000 lbs truck traveling 1,000 miles in New Mexico will pay higher WDT fees than a 30,000 lbs truck for the same distance.

3. How to Obtain a Permit

-

Register Online at https://www.newmexicotruckingonline.com/

-

Provide Vehicle Details: VIN, license plate, weight, fleet size.

-

Pay Applicable Fees: Fees are based on miles and vehicle weight.

-

Receive the Permit: Must be kept in the truck while operating.

4. Compliance & Enforcement

-

Carriers must report mileage accurately to avoid fines.

-

Vehicles may be inspected at weigh stations to ensure proper WDT payment.

-

Penalties for non-compliance can include fines, suspension of operations, or additional back taxes.

5. Tips for Trucking Companies

-

Keep detailed mileage logs for New Mexico routes.

-

Renew permits annually or when fleet changes.

-

Use online calculators to estimate WDT fees before entering the state.

Quick Takeaway:

If your truck or fleet exceeds 26,000 lbs and operates in New Mexico, a Weight Distance Tax Permit is required. The tax is based on vehicle weight and miles traveled, and failure to comply can lead to fines and operational delays.