What Is the New Mexico Weight Distance Tax?

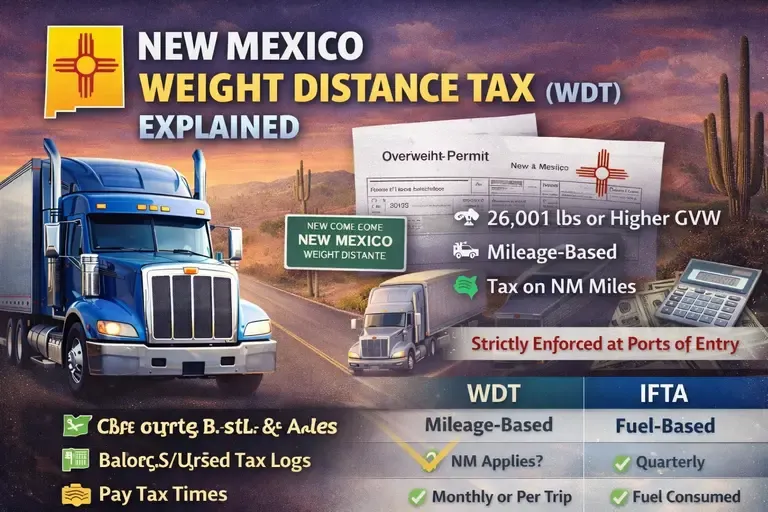

The Weight Distance Tax (WDT) is a mileage-based highway use tax charged to commercial vehicles based on:

-

Vehicle weight

-

Number of axles

-

Miles traveled in New Mexico

It applies whether you are:

-

In-state or out-of-state

-

For-hire or private

-

Operating under IRP or trip permits

Who Must Pay New Mexico WDT?

You must comply with WDT if your vehicle:

-

Has a GVW or combined weight of 26,001 lbs or more

-

Operates on public roads in New Mexico

-

Is registered under IRP, temporary registration, or trip permit

This includes:

-

Trucking companies

-

Owner-operators

-

Fleets

-

Construction, oilfield, and agricultural carriers (with limited exceptions)

WDT Exemptions (Limited)

Some vehicles may be exempt, such as:

-

Government-owned vehicles

-

Certain agricultural operations (specific conditions apply)

-

Vehicles under 26,001 lbs

Exemptions are narrow and closely reviewed during inspections.

How New Mexico WDT Is Calculated

Your WDT amount is based on:

1. Declared Vehicle Weight

Higher operating weight = higher tax rate.

2. Axle Configuration

More axles generally result in lower per-mile rates.

3. Miles Traveled in New Mexico

Only New Mexico miles are taxed.

Rates are set by the New Mexico Taxation and Revenue Department (TRD) and vary by weight class.

How to Pay New Mexico WDT

Option 1: WDT Account (Best for Regular Operations), create account at https://www.newmexicotruckingonline.com/

-

File monthly reports

-

Report miles by weight and axle group

-

Pay tax directly to New Mexico

Option 2: WDT Trip Permit, get the permits at https://www.newmexicotruckingonline.com/

-

Used for temporary or occasional operations

-

Covers a specific vehicle and time period

-

Common for out-of-state carriers

WDT vs IFTA (Important Difference)

| Feature | WDT | IFTA |

|---|---|---|

| Tax Type | Mileage-based | Fuel-based |

| Applies in NM | Yes | Yes |

| Reporting | Monthly or per trip | Quarterly |

| Based on | Weight + miles | Fuel consumed |

IFTA does NOT replace WDT. Many carriers must comply with both.

Enforcement & Penalties

New Mexico actively enforces WDT at:

-

Ports of Entry

-

Weigh stations

-

Roadside inspections

Violations may lead to:

-

Fines and penalties

-

Back taxes

-

Trip delays

-

Out-of-service orders

Required Records

Carriers must maintain:

-

Mileage and trip logs

-

Weight declarations

-

Permits and receipts

-

Vehicle registration documents

Records are typically required to be kept for at least 3 years.

Best Practices for Compliance

Declare accurate operating weight

Track New Mexico miles separately

Purchase WDT permits before entry

Keep documents accessible in the cab

File reports on time

Key Takeaways

-

New Mexico WDT applies to vehicles 26,001 lbs and above

-

Tax is based on weight, axles, and miles

-

Applies to in-state and out-of-state carriers

-

Separate from fuel tax and IFTA

-

Strictly enforced at ports of entry