For Oregon Weight Mile Permits- https://www.oregontruckingonline.org/

For New Mexico Weight Mile Permits - https://www.newmexicotruckingonline.com/

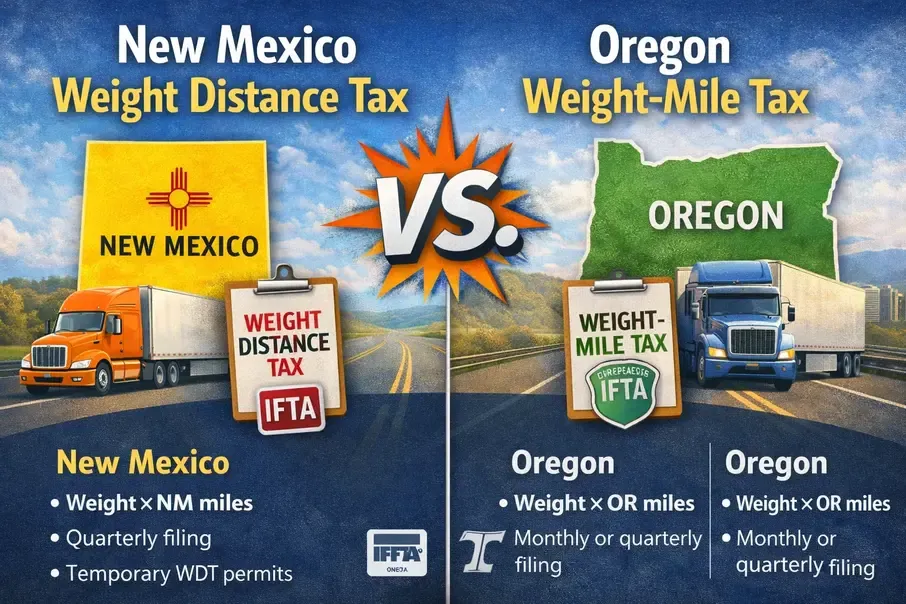

What Each Tax Is

New Mexico Weight Distance Tax (WDT)

A tax on commercial vehicles over 26,000 lbs for miles traveled within New Mexico, calculated by vehicle weight and distance.

Oregon Weight-Mile Tax (WMT)

A tax on commercial vehicles over 26,000 lbs for miles traveled within Oregon, also based on weight and miles, but it replaces IFTA fuel tax for most heavy vehicles in Oregon.

Key Differences at a Glance

| Area | New Mexico (WDT) | Oregon (WMT) |

|---|---|---|

| Applies to | Vehicles > 26,000 lbs | Vehicles > 26,000 lbs |

| Tax basis | Weight × miles in NM | Weight × miles in OR |

| Fuel tax relationship | Filed in addition to IFTA | Replaces IFTA for most heavy vehicles |

| Filing frequency | Quarterly | Monthly or quarterly |

| Temporary permits | 1-trip / 2-trip options | 10-day / 30-day permits |

| Reporting systems | NM Tax & Rev (TAP) | Oregon CCD / Revenue |

| Enforcement | Weigh stations, audits | Weigh stations, roadside checks |

| Common pain point | Dual filing (WDT + IFTA) | Detailed mileage & axle reporting |

How Rates Are Calculated

-

Both states use weight brackets (higher weight = higher per-mile rate).

-

Oregon’s rates can vary more due to axle configuration and detailed weight categories.

-

New Mexico’s rates are comparatively simpler, but still depend on declared weight and miles.

Fuel Tax Interaction (Big Difference)

-

New Mexico:

You generally file IFTA fuel tax and file WDT for miles driven in NM. -

Oregon:

For qualifying heavy vehicles, WMT replaces IFTA—you do not file IFTA for Oregon miles (you still file IFTA for other states).

Reporting & Filing

New Mexico

-

File quarterly.

-

Report NM miles by weight category.

-

Maintain trip sheets, fuel receipts, and distance records.

Oregon

-

File monthly or quarterly.

-

Report Oregon miles by weight and axle configuration.

-

Requires detailed records (trip reports, GPS/ELD summaries).

Permits & Temporary Operations

-

NM: Short-term operators without accounts can use temporary WDT permits.

-

OR: Offers 10-day or 30-day weight-mile permits, commonly used by out-of-state carriers.

Enforcement & Penalties

Both states actively enforce compliance through:

-

Weigh stations and roadside inspections

-

Audits and record reviews

Penalties may include fines, interest, citations, and out-of-service orders for non-filing or under-reporting.

Which Is More Complex?

-

Oregon WMT is often considered more complex due to axle-based reporting and replacing IFTA.

-

New Mexico WDT is simpler to calculate, but adds an extra filing on top of IFTA.

Key Takeaways

-

Both taxes are mandatory for heavy trucks operating in their states.

-

New Mexico = WDT + IFTA

-

Oregon = WMT instead of IFTA (for most heavy vehicles)

-

Accurate mileage and weight records are critical in both states.

https://www.mvd.newmexico.gov/commercial/commercial-vehicles/weight-distance/