Who Needs This Permit?

You must apply if your vehicle:

-

Has a GVW of 26,001 lbs or more, or

-

Has three or more axles regardless of weight, or

-

Carries hazardous materials requiring placarding

All interstate and intrastate carriers meeting these criteria must comply. Owner-operators and fleet owners alike are included.

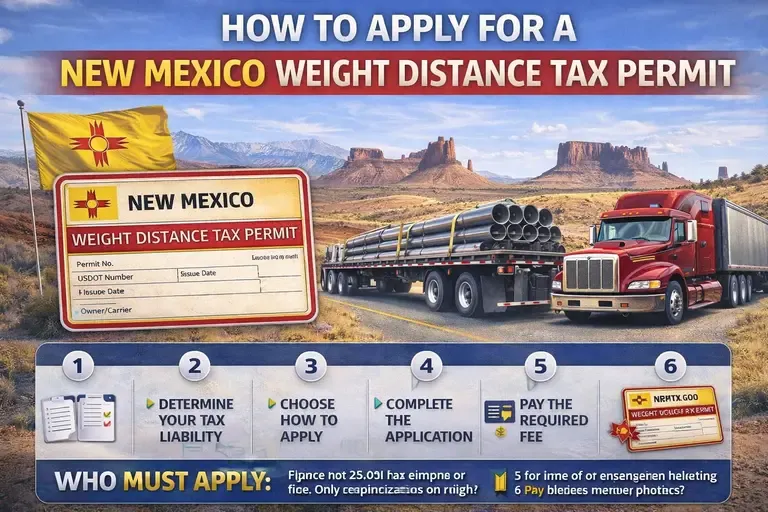

Steps to Apply for a New Mexico Weight Distance Tax Permit

1. Gather Required Information

Before applying, prepare:

-

USDOT number

-

Vehicle registration and title

-

Vehicle GVW and axle configuration

-

Company information (legal name, address, EIN if applicable)

-

Total estimated miles to be traveled in New Mexico

2. Determine Your Tax Liability

-

The Weight Distance Tax is based on miles traveled within New Mexico.

-

Rates are determined by vehicle weight and distance traveled.

-

You can estimate your tax using New Mexico Taxation & Revenue Department (TRD) tables.

3. Choose How to Apply

You can apply via:

-

Online: Through the https://www.newmexicotruckingonline.com/

-

Phone: (505) 578-2195

4. Complete the Application Form

Make sure all vehicle and mileage details are accurate. Mistakes can lead to penalties or rejected applications.

5. Pay the Required Fee

-

Fees are calculated based on:

-

Vehicle weight

-

Miles traveled in New Mexico

-

-

Payment can be made via: credit or debit card

6. Receive Your Permit

Once approved, you’ll get:

-

A Weight Distance Tax Permit to display in the vehicle

-

A reporting schedule for quarterly or annual mileage reporting

Keep the permit in the vehicle at all times during operations.

7. Maintain Compliance

-

Report miles quarterly or annually, as required

-

Update vehicle or company info if your fleet changes

-

Renew permits annually

Common Mistakes to Avoid

-

Failing to include all vehicles in your fleet

-

Underreporting mileage traveled in New Mexico

-

Waiting too long to apply before operating in the state

-

Not keeping permit or tax documents in the vehicle

Tips

-

Out-of-state carriers should plan ahead; permits are required before entering New Mexico

-

If operating under IFTA, ensure your fuel tax filing aligns with weight-distance reporting

-

Keep detailed odometer readings for all vehicles

Summary Checklist

| Step | Action |

|---|---|

| 1 | Gather company and vehicle information |

| 2 | Estimate weight distance tax based on miles and GVW |

| 3 | Submit application online at https://www.newmexicotruckingonline.com/ |

| 4 | Pay calculated tax fees |

| 5 | Receive and display permit in the vehicle |

| 6 | File quarterly/annual mileage reports and renew annually |