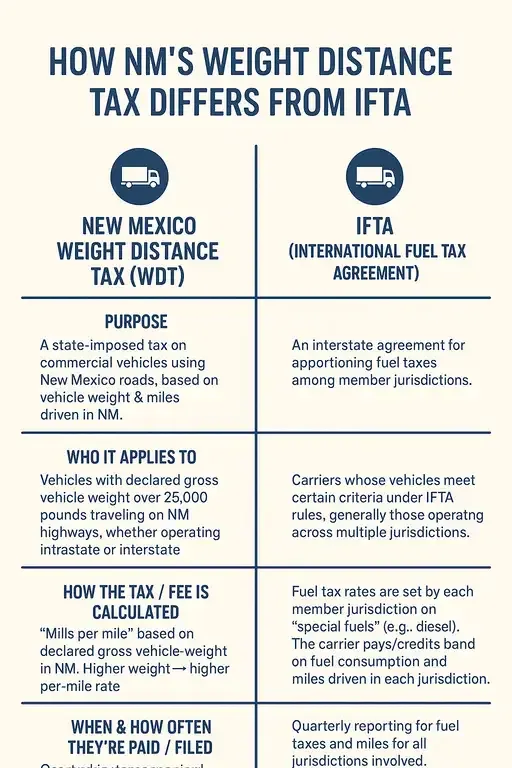

What They Each Are

| Term | New Mexico Weight Distance Tax (WDT) | IFTA (International Fuel Tax Agreement) |

|---|---|---|

| Purpose | A state-imposed tax in New Mexico on commercial vehicles using New Mexico roads, calculated based on vehicle weight & miles driven in NM. | An interstate (and inter‐Canadian province) agreement for apportioning fuel taxes among member jurisdictions. Carriers report total miles, fuel purchased, then allocate tax due/credit among states/provinces. |

| Who it applies to | Vehicles with declared gross vehicle weight over 26,000 pounds traveling on NM highways, whether operating intrastate or interstate.registered or apportioned. | Carriers whose vehicles meet certain criteria (weight, axles, combination weight) under IFTA rules — generally those operating across multiple jurisdictions. The base jurisdiction issues the IFTA license. |

How the Tax / Fee Is Calculated

| Feature | NM WDT | IFTA |

|---|---|---|

| Rate basis | “Mills per mile” based on declared gross vehicle weight in NM. Higher weight → higher per-mile rate. | Fuel tax rates are set by each member jurisdiction (state/province) on "special fuels" (e.g. diesel). The carrier pays/credits based on fuel consumption and miles driven in each jurisdiction. |

| Mileage component | Only miles driven in New Mexico highways. You must report the number of NM miles & total miles travelled. | You track miles traveled in each IFTA jurisdiction (i.e. each state/province you travel through) plus fuel used. These feed into apportionment of fuel taxes. |

| Weight requirement | Over 26,000 lbs declared GVW (or equivalent criteria) for vehicles. | Similar weight thresholds apply: vehicles over certain weight or with combination of axles/weight. The exact IFTA rules define qualified vehicles. |

When & How Often They’re Paid / Filed

| Feature | NM WDT | IFTA |

|---|---|---|

| Filing frequency | Quarterly returns required. Even if a vehicle did not travel through New Mexico during the period, the return must still be filed. | Quarterly reporting for fuel taxes and miles for all jurisdictions involved. Base jurisdiction files and makes the payment / credit adjustments. |

| Due dates | Specific quarterly deadlines: April 30, July 31, October 31, January 31 for the respective quarters. | IFTA deadlines depend on the rules of the base jurisdiction, but typically quarterly. (e.g., mileage/fuel dashboards are common.) |

| Annual option | There is an option for some registrants to pay annually instead of quarterly if their NM WDT liability (or combined WDT + special fuel tax, if applicable) from the previous year was under a certain threshold (e.g. $500). | No generally available “annual election” for IFTA — the agreement is designed around periodic (usually quarterly) settlements. |

Key Differences / What Carriers Should Know

-

What you’re paying for

-

WDT is a use / weight-distance tax: paying for how heavy your vehicle is and how many miles it travels within NM. It’s a state highway usage cost.

-

IFTA is a fuel tax apportionment system: it doesn’t charge you for weight or purely distance directly, but ensures you pay fuel taxes to jurisdictions where you drive, based on fuel consumed and miles driven.

-

-

Overlap & co-existence

-

A truck operating interstate through New Mexico may need both WDT (for NM roads & weight) and IFTA (for fuel tax across states) depending on its operations.

-

Being registered with IFTA does not automatically satisfy New Mexico’s WDT obligations. There are cases where carriers thought IFTA covered them, but New Mexico enforcement still imposed WDT liabilities.

-

-

Calculation details

-

WDT rates vary by declared GVW with graduated rates (more weight → higher mills/mile). NM also offers reduced rates (two-thirds) for vehicles that do one-way hauls or have a high percentage of empty (no load) miles.

-

In IFTA, the amount owed in each jurisdiction depends on the fuel tax rate in that jurisdiction and the miles you ran there; fuel purchases vs fuel tax already paid (or overpaid) are credited or balanced.

-

-

Vehicle registration / plate differences

-

In NM, vehicles subject to WDT get a Weight-Distance plate if intrastate, or IRP — apportioned — plate if interstate.

-

IFTA generally involves fuel tax credentials (license, decals) but does not affect vehicle plates except as required for state-level enforcement or registration.

-

-

Recordkeeping & audit risk

-

For WDT: must report NM miles, total miles, vehicle’s declared weight, maintain records for weight & mileage; recordkeeping required for 4 years in NM.

-

For IFTA: must keep fuel purchase receipts, mileage logs per jurisdiction, records of fuel consumed, etc. Audit risk if records are incomplete.

-

Example: Scenario Comparison

| Scenario | What NM WDT Might Cost | What IFTA Owes Might Look Like |

|---|---|---|

| A 60,000-lb truck drove 5,000 miles in New Mexico and 10,000 miles across other states. Declared GVW = 60,000 lbs. | WDT = (rate per mile for that weight class in NM) × 5,000 NM miles. (Check NM’s rate table: for 60,001-62,000 lbs it's about 31.24 mills/mile per current schedule). | Under IFTA: the company collects total fuel use, gets credit for taxes paid at fuel purchases, and allocates tax due or credit among NM and other states based on miles in each state. For the 5,000 NM miles, must pay NM’s fuel tax rate (minus credit) proportionally. |

✅ Bottom Line: What Carriers Want to Double-Check

-

Are you subject to NM’s WDT? (Vehicle over 26,000 lbs, declared GVW, using NM roads)

-

Are you registered under IFTA? If so, understand your base state’s filing requirements and how NM mileage/fuel rates impact your IFTA reports.

-

Both WDT and IFTA filings have deadlines, recordkeeping, and penalties for noncompliance. Missing one won’t excuse the other.

-

When calculating costs, factor both: WDT cost for NM usage plus IFTA fuel tax apportioned cost for NM (and other states).