What You Should Know First

-

The WDT in New Mexico applies to motor vehicles above a certain declared gross weight (over 26,000 lbs) that use New Mexico highways.

-

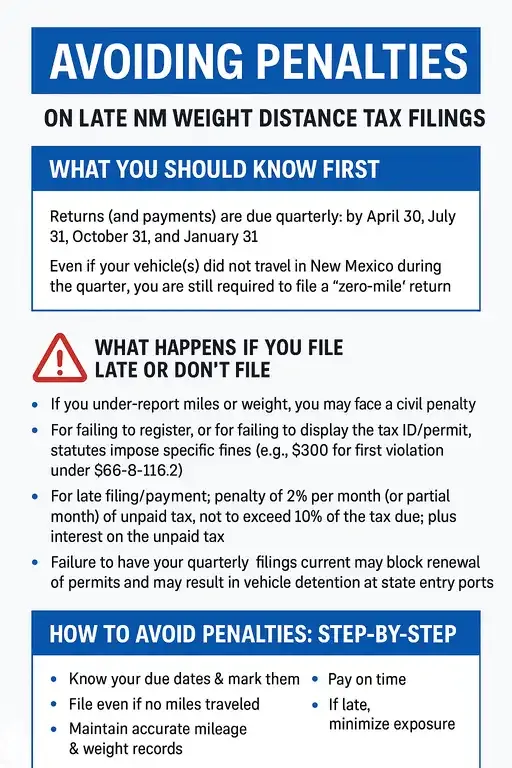

Returns (and payments) are due quarterly: by April 30 (for Jan-Mar), July 31 (Apr-Jun), October 31 (Jul-Sep), and January 31 (Oct-Dec).

-

Even if your vehicle(s) did not travel in New Mexico during the quarter, you are still required to file a “zero-mile” return.

-

Late or incomplete filing may trigger both interest and penalties under New Mexico law.

What Happens If You File Late or Don’t File

Some key consequences to watch out for:

-

If you under-report miles or weight (i.e., report less than actual) for a tax period, you may face a civil penalty: for example, if your owed tax is between $1-99 the penalty is $100; for $2,500+ tax owed it’s $4,000.

-

For failing to register, or for failing to carry required tax ID/permit: statutes impose specific fines (e.g., $300 for first violation under §66-8-116.2).

-

For late filing/payment: one source (older form instructions) indicated a penalty of 2% per month (or partial month) of unpaid tax, not to exceed 10% of the tax due; plus interest on the unpaid tax.

-

Failure to have your quarterly filings current may block renewal of permits and may result in vehicle detention at state entry ports.

How to Avoid Penalties: Step-by-Step

1. Know Your Due Dates & Mark Them

-

Calendar the four due dates: April 30, July 31, October 31, January 31.

-

If you pay annually (and you qualify), know that election rules apply and you must pay by the January 31 deadline.

2. File Even If No Miles Traveled

-

If you had no New Mexico miles for the quarter, still file the required return (zero miles) to show compliance. Missing this is still a “non-filing”.

3. Maintain Accurate Mileage & Weight Records

-

Keep logs of miles driven in New Mexico vs total miles, the declared gross vehicle weight, and other required data.

-

Under-reporting is penalized heavily.

4. File Electronically If Required

-

If you have two or more trucks / vehicles subject to the tax, you’re required to file electronically.

-

Ensure you get electronic confirmation if required; missing that may delay crediting and lead to interest/penalties.

5. Pay On Time & In Full

-

Late payment triggers interest plus any applicable late‐payment penalty (2% monthly or other as applicable).

-

Make sure your payment has all required identification so it gets applied properly.

6. If Late, Minimize Exposure

-

If you realize you will be late, file as soon as possible and pay what you owe — the sooner you act, the lower the interest/penalty accumulation.

-

Keep documentation showing your effort to file/pay to mitigate audit risk.

-

Ask if your situation qualifies for “zero” filing or annual election to simplify future compliance.

7. Review Permit Requirements & Renewal

-

Your WDT account needs to be in good standing (all returns filed, all taxes paid) to renew your annual permit (if applicable).

-

If you fail to keep up, you may lose your permit, or your vehicle may be detained at state entry.

Summary Checklist

-

Mark quarterly due dates on your calendar

-

File return every quarter (including zero miles)

-

Maintain accurate mileage & weight logs

-

File electronically if required

-

Pay tax on time and ensure proper identification on payment

-

If late, act immediately and document your efforts

-

Keep account current to maintain permits and avoid detentions